Central Bank Digital Currencies (CBDCs) are becoming a major topic in finance and policy as governments explore digital versions of national money. In simple terms, a CBDC is a digital form of a country’s official currency issued and backed by its central bank.

Unlike decentralized cryptocurrencies such as Bitcoin, CBDCs are state-issued and designed to function within the regulated financial system. That does not mean every country will build CBDCs the same way. Design choices vary widely, and the real-world impact depends on how a CBDC is implemented, who can use it, and what privacy and banking safeguards are built in.

In this guide, you’ll learn what CBDCs are, how they can work, the main potential benefits, the biggest risks and criticisms, and why global CBDC development looks very different from one country to another.

What is a CBDC?

A CBDC (Central Bank Digital Currency) is a digital version of a country’s sovereign fiat currency. It is issued by the central bank and represents a direct claim on the state, similar to physical cash in legal status (depending on the jurisdiction’s legal framework).

Instead of existing as paper bills or coins, a CBDC exists in digital form and is recorded using secure payment infrastructure. A CBDC may use centralized databases, distributed ledger systems, or hybrid architectures depending on the country’s policy and technical choices.

CBDCs vs Cryptocurrencies and Stablecoins

CBDCs are often compared with cryptocurrencies and stablecoins, but they are not the same:

- CBDCs are issued and controlled by a central bank.

- Cryptocurrencies (e.g., Bitcoin) are typically decentralized and not issued by a state.

- Stablecoins aim to maintain a stable value, but they are usually issued by private entities and rely on different reserve and governance models.

CBDCs are also often discussed alongside decentralized systems, but the governance model is very different from decentralized finance (DeFi) platforms and protocols.

This distinction matters because the key debate around CBDCs is not only technology — it is also about monetary control, privacy, and the role of commercial banks. If you want a broader primer on private digital assets, you can also read our guide on how stablecoins work and how they differ from state-issued digital money.

Types of CBDCs

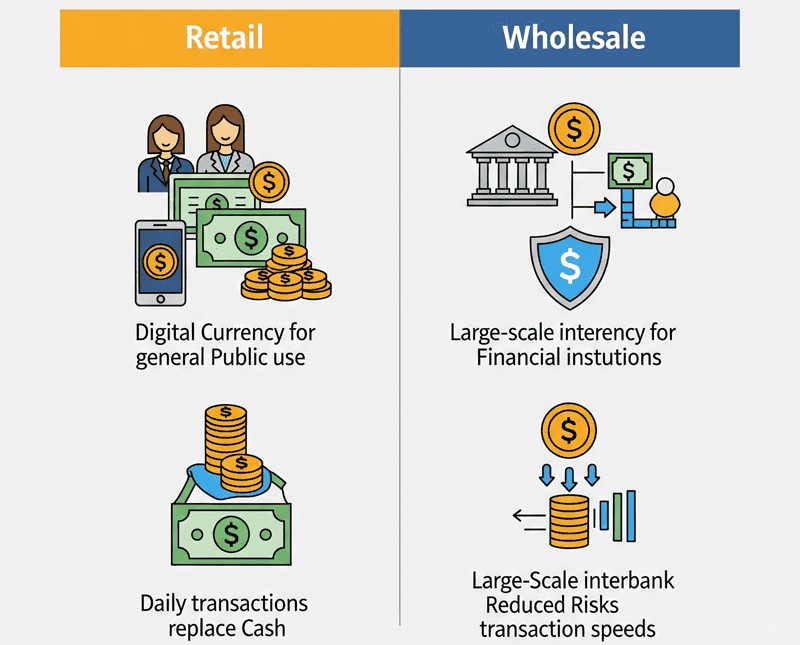

Most CBDC discussions focus on two broad models:

1) Retail CBDCs

Retail CBDCs are designed for the general public (individuals and businesses). In theory, they could be used for everyday payments such as shopping, transfers, or bill payments.

Potential use cases include:

- faster domestic payments,

- lower payment costs,

- improved access to digital money for underbanked users.

2) Wholesale CBDCs

Wholesale CBDCs are designed for financial institutions, not the general public. They are mainly discussed for use in:

- interbank settlements,

- cross-border payment infrastructure,

- securities and large-value transfers.

Wholesale models are often seen as less disruptive to consumer banking because they focus on institutional settlement efficiency rather than retail deposits.

How Do CBDCs Work?

There is no single technical model for CBDCs. How they work depends on the policy goals and infrastructure choices of each central bank.

In practice, a CBDC system may include:

- Issuance and control by the central bank

- Wallets or account-based access for users or institutions

- Identity and compliance controls (e.g., AML/KYC requirements)

- Transaction processing infrastructure (centralized, distributed, or hybrid)

- Rules for privacy, limits, and offline functionality (if supported)

Important: Not Every CBDC Works the Same Way

Some common assumptions are too broad. For example:

- not every CBDC uses blockchain,

- not every model supports peer-to-peer transfers without intermediaries,

- and offline payments are a design option, not a guaranteed feature.

This is one reason CBDC discussions can become confusing: the term “CBDC” describes a category, not a single product.

Potential Benefits of CBDCs

CBDCs are often promoted for their potential policy and payment-system benefits. The actual benefits, however, depend on implementation quality and user adoption.

1) Payment Efficiency

CBDCs may improve payment speed and reduce friction in domestic transfers, especially where current systems are slow or expensive.

2) Financial Inclusion

In some countries, a well-designed retail CBDC could improve access to digital payments for people who are unbanked or underbanked especially if the system supports low-cost onboarding and simple wallet access.

3) Reduced Reliance on Cash Infrastructure

As cash usage declines in some regions, CBDCs may provide a public digital payment option backed by the state.

4) Better Settlement Infrastructure (Especially Wholesale Use)

Wholesale CBDCs may help improve interbank settlement processes and potentially support more efficient cross-border payment experiments.

5) Programmability and Policy Design Options

Some CBDC models may support programmable features (with legal and policy limits), which could enable new forms of compliance automation or targeted payment functionality.

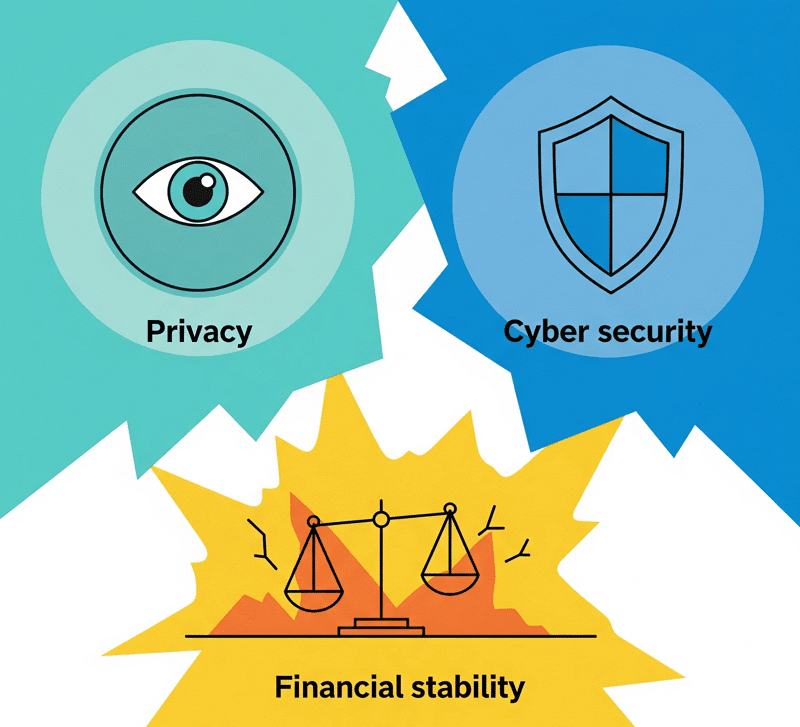

Key Risks and Criticisms of CBDCs

CBDCs also raise major concerns. These are not minor details they are central to whether a CBDC model gains public trust.

1) Privacy and Surveillance Concerns

One of the biggest criticisms is that CBDCs could increase state visibility into transactions if privacy protections are weak. The design of identity systems, transaction records, and access controls matters significantly.

2) Cybersecurity and Operational Risk

A national digital currency system would require strong resilience against cyberattacks, outages, fraud, and technical failures. Even short disruptions could have systemic consequences.

3) Banking Sector Disruption

If consumers move large amounts of money from commercial bank deposits into CBDC wallets, banks could face funding pressure. Many CBDC proposals try to reduce this risk using limits, tiered remuneration, or restricted use models.

4) Legal and Governance Complexity

CBDCs require more than technology. They involve legal changes, regulatory frameworks, institutional coordination, and public policy trade-offs.

5) Public Adoption and Trust

A CBDC can be technically sound and still fail to gain traction if users do not trust it, understand it, or see a clear advantage over existing payment options.

Why CBDCs Are Controversial

CBDCs are often discussed as a technical innovation, but the controversy is mostly about policy design and power structures.

The main tension is this:

- Supporters see CBDCs as a way to modernize public money and payment infrastructure.

- Critics worry about privacy, centralized control, and unintended effects on financial freedom and banking systems.

Both sides are responding to real issues. That is why serious CBDC analysis should focus on design choices, not just the label “CBDC.” Public trust is one of the hardest parts of CBDC design, and adoption challenges can remain even when the technology works as intended — especially when users do not see a clear benefit over existing payment systems. We discuss this further in our analysis of why CBDCs struggle with adoption.

Global CBDC Developments: Why Approaches Differ

Countries are researching and testing CBDCs for different reasons, including payment modernization, sovereignty concerns, financial inclusion goals, or strategic policy interests. As a result, CBDC models differ by country in terms of:

- policy objectives,

- technology choices,

- rollout strategy,

- legal framework,

- and privacy architecture.

This means readers should avoid assuming that one country’s CBDC pilot automatically predicts how another country will design or use a CBDC.

What CBDCs Could Mean for Consumers and Businesses

For consumers and businesses, the practical impact of CBDCs would depend on implementation details such as:

- whether the CBDC is retail or wholesale,

- how wallets are provided,

- whether fees are lower than current payment options,

- privacy protections,

- transaction limits,

- and integration with existing banking and payment apps.

In other words, the question is not only “What is a CBDC?” but also “What kind of CBDC is being proposed, and under what rules?”

Final Thoughts

CBDCs represent an important shift in how governments and central banks are thinking about digital money. They may improve payment infrastructure and expand access in some contexts, but they also introduce real risks related to privacy, cybersecurity, and financial system design.

The most useful way to evaluate CBDCs is to move beyond hype — both positive and negative — and examine the specific model, legal safeguards, and implementation goals in each country.

If you’re exploring related topics, it also helps to understand how CBDCs differ from stablecoins, cryptocurrencies, and decentralized finance systems, since these are often discussed together but operate under very different rules.

For reliable background research, use institutional sources such as the IMF’s CBDC topic resources and policy research from the Bank for International Settlements (BIS).

If you’re new to digital assets and digital money tools, reviewing digital wallet security best practices can help you better understand practical risks around storage, access, and fraud.