In crypto markets, price volatility is common but many users still need a way to move or store digital value without constant price swings. That is where stablecoins come in.

A stablecoin is a type of digital asset designed to track a relatively stable value, usually a fiat currency such as the U.S. dollar or euro. Stablecoins are widely used in trading, payments, cross-border transfers, and decentralized finance (DeFi), but they are not all built the same way and they do not all carry the same risks.

In this guide, we’ll explain what stablecoins are, how they maintain their value, where they are commonly used, and the key risks you should understand before using them.

What Is a Stable Coin?

A stablecoin is a type of cryptocurrency designed to maintain a relatively stable price, often by being pegged to a reference asset such as the U.S. dollar or euro.

Unlike highly volatile assets such as Bitcoin or Ethereum, stablecoins are meant to reduce short-term price fluctuations and make digital transactions more predictable. They are often used as a bridge between traditional money and crypto-based financial systems.

Stablecoins also differ from Central Bank Digital Currencies (CBDCs), which are issued and controlled by national central banks. Stablecoins are generally issued by private companies or decentralized protocols, depending on the model.

If you want a deeper comparison, you can also read our article on how CBDCs work, their potential benefits, and key risks.

Why Stablecoins Matter

Stablecoins matter because they help solve a practical problem in crypto: many people want the speed and accessibility of digital assets without the extreme volatility.

They are commonly used for:

- moving value between exchanges or wallets,

- reducing exposure to crypto price swings,

- cross-border payments and transfers,

- participating in DeFi applications,

- holding digital dollar- or euro-pegged value in unstable currency environments.

That said, “stable” does not mean “risk-free.” Stability depends on the design model, reserve quality, market liquidity, and user confidence.

How Stable Coins Maintain Their Value

Keeping a stable price in open markets is difficult. Different stablecoins use different mechanisms to maintain their peg.

1) Fiat-Backed Stablecoins

These are typically backed by reserve assets (such as cash or cash-equivalent instruments) and are designed to maintain a 1:1 peg to a fiat currency.

Examples often discussed in the market include dollar-pegged stablecoins issued by centralized entities. In principle, users trust the peg because the issuer claims to hold reserves that support redemption.

Key trade-off: usually simpler to understand, but users depend on the issuer’s reserve management, transparency, and compliance.

2) Crypto-Backed Stablecoins

These stablecoins use crypto assets as collateral and often rely on smart contracts to manage issuance and liquidation rules.

Because the collateral itself can be volatile, these systems often require over-collateralization (holding more collateral value than the stablecoins issued).

Key trade-off: more decentralized design potential, but more complex risk management and dependence on collateral behavior.

3) Algorithmic or Non-Fully-Reserved Models

Some models attempt to maintain a peg through supply adjustments, incentives, or other market mechanisms rather than fully backing each token with traditional reserves.

These designs can be more experimental and may carry higher failure risk during periods of market stress or loss of confidence.

Key trade-off: innovation and capital efficiency in theory, but often greater fragility if the stabilization mechanism breaks down.

Stablecoin Models: Which Type Fits Which Use Case?

Not every stablecoin model is equally suitable for every user or use case. A practical way to evaluate them is to ask:

- Do you prioritize simplicity and liquidity?

- Do you prioritize decentralization?

- Do you need a stablecoin mainly for payments, trading, or DeFi?

- How much issuer risk or smart contract risk are you comfortable with?

In general:

- Users focused on trading liquidity and convenience often prefer widely supported fiat-backed options.

- Users focused on decentralization may prefer crypto-collateralized models, while accepting more complexity.

- Users seeking “yield” should be especially careful not to confuse stablecoin price stability with platform or protocol safety.

Examples of Widely Used Stablecoins

There are many stablecoins in the market, but only a smaller group tends to see broad usage across exchanges, wallets, and applications. Instead of treating any list as permanent, it is better to evaluate stablecoins by use case, transparency, liquidity, and risk model.

Here are common examples often referenced in the market:

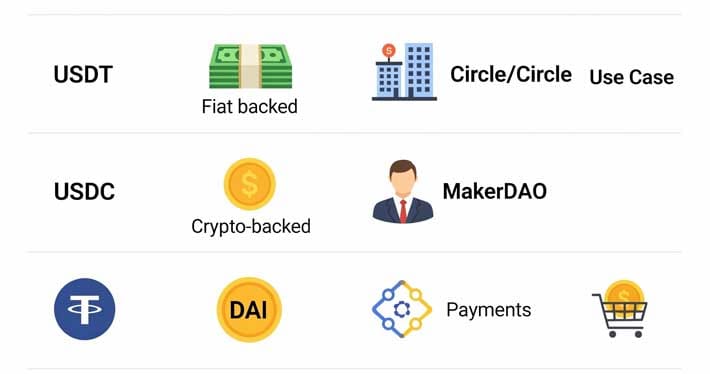

USDC (USD Coin)

Issued by Circle and fully backed by cash and short-term government bonds, USDC has become one of the most transparent and regulated stable coins in the market. It’s widely used in both retail and institutional crypto transactions. USDC is often preferred by users who care about regulatory compliance and clean auditing practices.

USDC (USD Coin)

USDC is commonly discussed as a fiat-backed dollar stablecoin used across exchanges, wallets, and payment integrations. Many users prefer it for its broad ecosystem support and regulatory-facing positioning.

USDT (Tether)

USDT remains one of the most widely used stablecoins for trading and liquidity across many platforms. Its market role is significant, especially for active traders and exchange transfers.

DAI

DAI is a crypto-collateralized stablecoin associated with decentralized finance ecosystems. It is often used by users who prefer a more protocol-based model rather than a centralized issuer model.

EURC and Other Non-USD Stablecoins

Euro-pegged and other fiat-pegged stablecoins are also relevant, especially for users and businesses that prefer local-currency-denominated digital assets.

Payment-Focused Stablecoin Integrations (e.g., major payment platforms)

Some stablecoins are designed or positioned for payments and ecosystem integration. Their practical usefulness depends not only on the token design, but also on merchant support, wallet compatibility, and regulatory context.

How Stablecoins Are Used in Practice

Stablecoins are used for much more than trading. Their real-world utility depends on the platform, jurisdiction, and user goals.

1) Trading and Liquidity Management

Stablecoins are widely used as a trading pair and as a temporary “parking” asset when users want to reduce exposure to volatile crypto positions without exiting into fiat.

2) Cross-Border Transfers

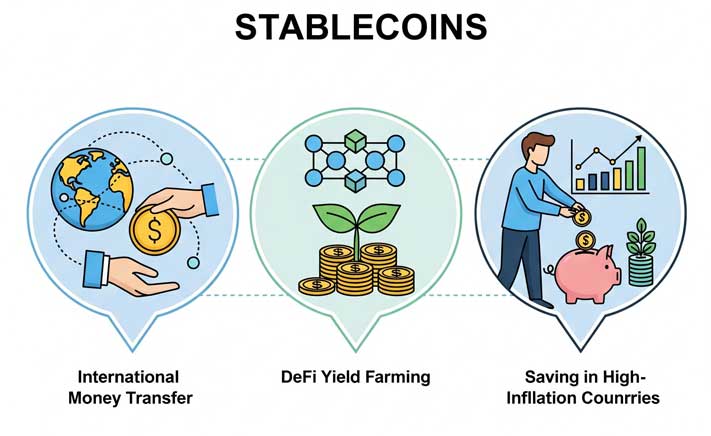

In some cases, stablecoins can support faster or cheaper value transfer compared with traditional payment rails — especially when both sender and receiver already use compatible wallets or exchanges.

3) DeFi Applications

Stablecoins are commonly used in decentralized finance for lending, borrowing, liquidity provision, and other on-chain financial activities.

If you want to understand the broader context, read our article on how decentralized finance (DeFi) is changing banking.

4) Saving or Holding Digital Value in Unstable Economies

In countries experiencing inflation, currency devaluation, or restricted access to foreign currency, some users turn to stablecoins as a digital alternative for storing value. However, access, legal treatment, and platform risks vary widely by country.

Stablecoin Price and Peg Behavior: Why “$1” Is Not Always Exactly $1

A stablecoin pegged to $1 may still trade slightly above or below its target price (for example, $0.998 or $1.002). Small deviations are common and usually reflect normal market activity.

Price deviations can become larger when there is:

- sudden market stress,

- redemption friction or delays,

- reduced liquidity on certain platforms,

- concerns about reserves or collateral quality,

- broader loss of market confidence.

This is why “stable” should be understood as a design goal, not a guarantee.

Key Risks to Understand Before Using Stablecoins

Stablecoins can be useful tools, but users should evaluate the risks based on the specific token and platform they use.

1) Issuer and Reserve Transparency Risk

For fiat-backed models, an important question is whether the issuer provides credible, timely, and sufficiently detailed reserve disclosures.

2) Depeg Risk

Stablecoins can temporarily or persistently lose their peg under stress. This can happen due to liquidity shortages, market panic, collateral problems, or confidence shocks.

3) Platform and Custody Risk

Even if a stablecoin itself holds its peg, users can still lose funds due to exchange failures, wallet compromise, or custody mistakes.

If you use stablecoins through wallets and exchanges, reviewing digital wallet security best practices is essential.

4) Smart Contract and Protocol Risk

Crypto-backed or DeFi-integrated stablecoins may depend on smart contracts, oracle systems, liquidation mechanisms, and protocol governance all of which introduce technical and operational risk.

5) Regulatory and Access Risk

Stablecoin availability, issuer requirements, and platform support may change as regulations evolve. A stablecoin that is easy to use in one country or platform today may face restrictions or delistings elsewhere later.

Stablecoins, Regulation, and CBDCs: How They May Coexist

Stablecoins are increasingly part of regulatory discussions in major markets. Policymakers are focused on reserve quality, consumer protection, financial stability, and payment-system risk.

At the same time, central banks are exploring or testing CBDCs. Stablecoins and CBDCs are often framed as competitors, but the relationship may be more nuanced:

- CBDCs may serve as public digital money infrastructure (depending on country design),

- while stablecoins may continue to support private-sector innovation, trading, and certain payment applications.

Whether they compete directly or coexist in practice will depend on regulation, user adoption, technical design, and integration into real payment systems.

Final Thoughts: How to Evaluate Stablecoins

Stablecoins are now a core part of the digital asset ecosystem, but users should avoid treating them as interchangeable or risk-free.

A better approach is to evaluate each stablecoin by:

- stability mechanism

- reserve/collateral model

- liquidity and platform support

- transparency

- regulatory context

- your actual use case (trading, payments, savings, or DeFi)

In other words, the most useful question is not only “Which stablecoin is best?” but “Which stablecoin model best fits my use case and risk tolerance?”

For deeper policy and system-level analysis, use institutional sources such as the Bank for International Settlements (BIS) and official regulatory or central bank publications rather than relying only on exchange marketing pages or social media threads.